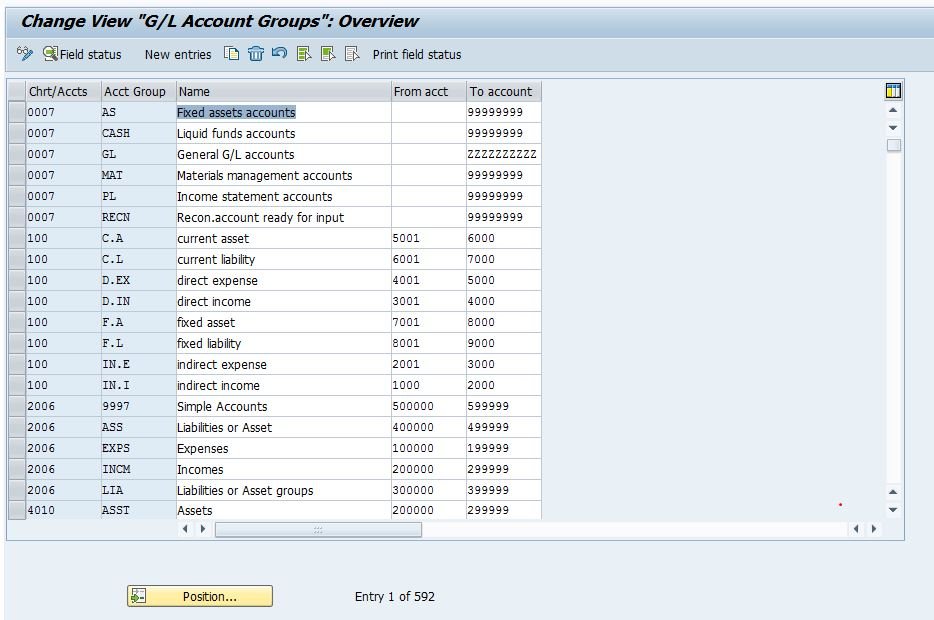

An account group is segregating or grouping similar accounts into a single group. Each account group in SAP is assigned to a chart of accounts, so you can only use the account group if the controlling areas use the same chart of accounts.

If we want to check current asset balances or prepare P&L accounts, Balance sheet; we need to verify each and every account and then you need to add and assign to their respective accounts. This process may take a lot of time. So to overcome this issue SAP has provided account groups.

In Real-time business scenario, we suggest

- All Liabilities accounts to start with 1 series.

- All Asset accounts to start with 2 series.

- All income accounts to start with 3 series.

- All Expenditure accounts to start with 4 series.

Why we need to follow accounts within series – When the user posting to salaries account, which is an expenditure account. At the time of posting when he gives *4, only expenditure accounts appear in the list.

In this configuration, we are going to define the following account groups.

| Chrt/Accts | Acct Group | Name | From Acct | To account |

| RIL | SCPL | Share Capital | 100000 | 100099 |

| RIL | RSPL | Reserves & Surplus | 100100 | 100199 |

| RIL | ACBL | Accumulated Depreciation | 100200 | 100299 |

| RIL | SCLN | Secured Loans | 100300 | 100399 |

| RIL | UNSL | Unsecured Loans | 100400 | 100499 |

| RIL | CLPR | Current Liabilities & Prov | 100500 | 100599 |

| RIL | FAST | Fixed Assets | 200000 | 200099 |

| RIL | CAST | Current Assets, Loans & Adv | 200100 | 200199 |

| RIL | SALE | Sales | 300000 | 300099 |

| RIL | OTHR | Other Income | 300100 | 300199 |

| RIL | INCR | Increase / Decrease in Stock | 300200 | 300299 |

| RIL | RMCN | Raw Material Consumption | 400000 | 400099 |

| RIL | PRSN | Personnel Cost | 400100 | 400199 |

| RIL | MFRG | Manufacturing cost | 400200 | 400299 |

| RIL | ADMN | Administration cost | 400300 | 400399 |

| RIL | INTR | Interest | 400400 | 400499 |

| RIL | DEPR | Depreciation | 400500 | 400599 |

Path SPRO –> Financial Accounting(New) –> General Ledger Accounting(New) -> Master Data —> G/L Accounts —> Preparations —> Define Account Group.

TC:- OBD4

| Field Name | Description |

| Chrt/Accts | Give the chart of accounts key for which you are creating account group in SAP. |

| Acct Group | We can use four-character length unique alphanumeric key. This is used for identifying accounts groups |

| Name | Name of the account group |

| From Account | Starting number of account group |

| To Account | Ending number of account group |

We can give different numbers of intervals for different groups; otherwise, we can give the same interval to all account groups. The system allows overlapping here. But the advice is to give a different interval to different groups.

Reason for selection of 6 digit coding

If we planned to use 4 digit coding to the chart of accounts It is difficult to create new groups in the future. As we are assigning 100 accounts to each group. If any group is completed with 100 accounts it is difficult to create more groups if the accounts digit is 4.

If the account group is 10 digits. It is difficult to remember the account group hence we suggested/recommended to use 6 digits.

If we created account groups for liabilities up to 1599, we can’t create more than 4 another group

1999 – 1599 = 400 / 100 = 4 groups

Suppose if we are using 6 digit number for the group, we can create

199999 – 100599 =99400 / 100 = 994 groups

So we suggested going for 6 digit account groups