Tolerance group for employees is to restrict/control the users for posting the documents. Here we can give user wise maximum limit for tolerance groups.

In the SAP system we can specify in advance various monetary limits for our employees with which we determine:

- The maximum document amount the employee is authorized to post.

- The maximum amount the employee can enter as a line item in a customer or vendor account.

- The maximum cash discount percentage the employee can grant in a line item.

- The maximum acceptable tolerance for payment differences for the employee.

Payment differences are posted automatically within certain tolerance groups. This way the system can post the difference by correcting the cash discount or by posting to a separate expense or revenue account.

In this respect we define

The amounts or percentage rates up to; which the system automatically posts to a separate expense or revenue account if it is not possible to correct the cash discount.

Or

Up to the amount difference, the system is to correct the cash discount. In this case, the cash discount is automatically increased or decreased by the difference using the tolerance groups.

Path: SPRO –> IMG –> Financial Accounting –> G/L Accounting (New) –> Business Transactions –> Open Item Clearing –> Clearing differences –> Define tolerance groups for Employees.

TC:- OBA4

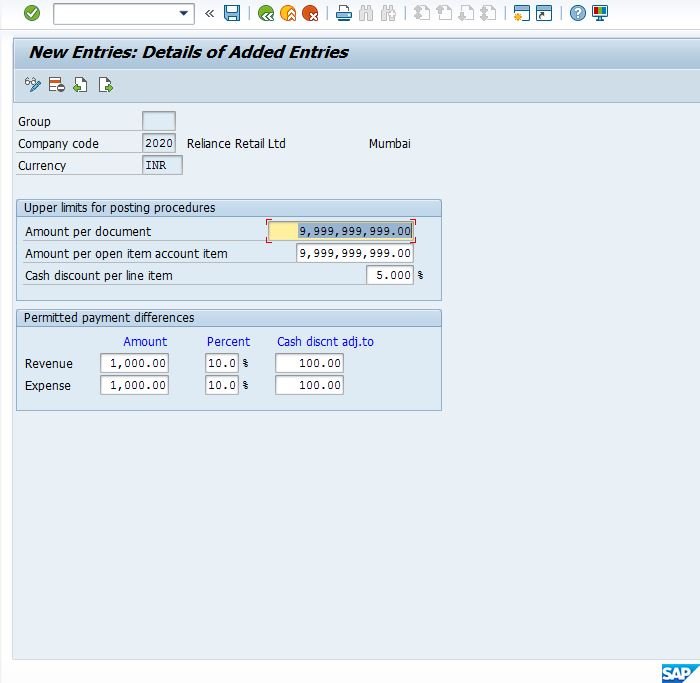

| Field Name | Description |

| Group | Enter the alphanumeric identifier (Maximum four digits) of the group, We can also create a Null group. |

| Company Code | Enter the identifier of the company code to which the tolerance group being configured belongs. |

| Currency | The currency will be automatically updated based on the company code |

| Amount Per Document | Enter the maximum amount that can be posted in a single accounting document. |

| Amount per open item account item | Enter the maximum amount that can be posted to a vendor or customer account. this field restricts the amount that can be paid to a vendor or cleared from receivables for a customer. |

| Cash Discount Per Item | Enter the maximum percentage for a cash discount that can be applied to a line item. for example:- a cash discount rate 5% would mean that the maximum cash discount that can be granted on a hundred rupees is 5. |

| Amount, Percent and cash discount adjustment [both revenue and expense] | These fields are used to deal with the handling of customer overpayments and underpayments to the company. in the amount field, enter the maximum amount of customer overpayment or the maximum amount of customer underpayment. that can be processed by this tolerance group. in the percentage, the field enters the maximum percent of the total payment that can be applied by this tolerance group. the system looks at both the amount and percentage field when making postings. the system will post differences up to the maximum percentage specified as long as it does not go over the amount specified in the amount field. in the cash discount Adj to Field, enter the amount of the difference that is to be posted to the cash discount account. Typically this field is set to be a lower figure than the amount field. |